Incorporation Guides

Israel – Company Incorporation Guide

Set up an Israeli Ltd

with confidence. Step-by-step guidance for foreign founders on documents, timeline, costs, taxes, VAT, banking, and ongoing annual filings, plus typical setup pitfalls. Israel is a fast-moving innovation market with strong startup talent, active investors, and high compliance and KYC expectations.

Estonia – Company Incorporation Guide

Set up an Estonian OÜ with foreign ownership. Online registration in 2 to 3 days with e-ID, 0% tax on retained earnings, and VAT and compliance rules. Includes guidance on contact person and banking for non-residents. Estonia is a digital-first EU market with efficient administration and simple online processes.

Singapore – Company Incorporation Guide

Form a Singapore Pte. Ltd. with 100% foreign ownership. One local resident director is required, with 17% corporate tax and 9% GST. Practical guidance on FSIE rules, filings, and banking for non-residents. Singapore is a stable, pro-business hub with strong banking and efficient regulation regionally.

Cyprus – Company Incorporation Guide

Incorporate a Cyprus Ltd with 100% foreign ownership. Fast setup, 12.5% corporate tax, plus VAT thresholds and registration rules. Covers UBO disclosures, substance expectations, and banking steps for non-residents. Cyprus is a stable EU services hub with good connectivity for Europe and the Middle East.

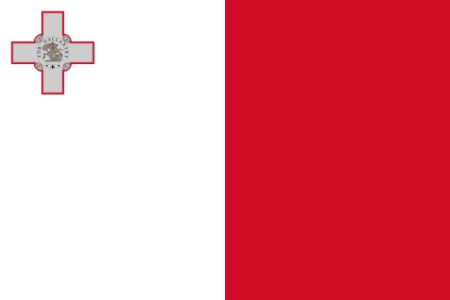

Malta – Company Incorporation Guide

Set up a Malta company with 100% foreign ownership. Share capital basics, 35% tax with refund mechanism where applicable, and VAT registration rules. Includes local MBR deadlines and banking guidance for non-residents. Malta is an EU jurisdiction that works best when substance is planned early.

Brazil – Company Incorporation Guide

Register a Brazil LTDA/SLU for foreign owners. Covers local representative requirements, CNPJ registration, and common tax regimes like IRPJ/CSLL. Clear practical guidance on KYC, ongoing compliance, and banking considerations for non-residents. Brazil is a large domestic market, but taxes and bureaucracy need strong local execution.